- 0

Loans Originated

- 0

Loan Limit

- 0

Day Closes

- 0

Transactions Funded

Our authority in the hard money lending space is built on a foundation of successful outcomes and satisfied clients. Over the years, we’ve not only adapted to the ever-changing real estate landscape but have also been at the forefront of innovation in lending practices. Our advice and financial solutions are sought after by investors, brokers, and real estate professionals. And we are proud of the feedback they provide.

are heading to your Inbox!

Our Strength

-

Same day underwriting

We provide underwriting decisions on the same day, allowing for quick and efficient loan processing.

-

All types of properties

Our loans cover all types of properties, including residential, commercial, industrial, and land.

-

Rates from 8,99%

We offer competitive interest rates starting from 8.99%, ensuring affordable financing options.

-

Loans from $150K to $30M

Flexible loan amounts ranging from $150,000 to $30 million to suit different needs and project sizes.

-

More Strengths

We provide personalized loan solutions, tailored terms, and excellent customer support to meet your specific needs.

Get personalized quote

Fast, Simple, and Tailored Just for You.

Get My Quote

Our journey began with a simple vision: to offer real estate investors, developers, and professionals an alternative to the slow, impersonal lending process. Today, our extensive portfolio of funded projects reflects a wide range of investments, from residential SFRs to commercial developments, showcasing our capacity to handle financial needs of any scale. Our deep understanding of the market dynamics allows us offer flexible and tailored hard money loan programs.

Programs

SFR, CONDO AND 2-4 UNITS

1st Liens

- Up to 75% LTV.

- Rates from 9.99%.

- 12 – 24 months loan term.

- Minimum 600 FICO, lower – exception only.

2nd Liens

- Up to 65% CLTV.

MULTIFAMILY

1st Liens

- Up to 75% LTV.

- Rates from 9.99%.

- 12 – 24 months loan term.

- Minimum 600 FICO, lower – exception only.

2nd Liens

- Up to 65% CLTV.

Residential

Read more

RETAIL, INDUSTRIAL, OFFICE

1st Liens

- Up to 75% LTV.

- Start rate – from 9.99%.

- 12 – 24 months loan term.

- Minimum 600 FICO, lower – exception only.

2nd Liens

- Up to 65% CLTV.

- 1st lien must be conventional bank & must agree to junior lien.

Commercial

Read more

RESIDENTIAL (1-4 UNITS)

Up to 85% LTC but not to exceed 65% LTARV- From 10% rate.

- Minimum score – 640.

- 12 months. Longer term possible depending on scenario.

- “No-experience” flippers – case by case.

- Marketable location.

Fix and Flip

Read more

GENERAL GUIDELINES

- Purpose: Purchase and refinance. transactions Loan Amounts: $150K – $25MM.

- Term: 12 months, interest only. Longer term available in some cases (up to 24 months).

- Credit Score: Not credit score driven.

- Prepayment Premium: Case by case.

- Broker Fees: Case by case but minimum is 2 points.

- Lender Fees: Average of $2,500.

- Other Fees: Valuation, due diligence fees – depending on transaction.

UNDERWRITING GUIDELINES

- Experience: First Time Investor MAX 65% LTV.

- Income Verification: Simple documentation.

- Down Payment: No source

- Appraisal Process: Contact your Account Executive to learn about our streamlined process and cost. Impounds None.

- Foreign Investors: 65% maximum LTV.

Bridge Loans: General Guidelines

Read more

Testimonials

More reviewsAbout Us

Lending Bee, Inc.

Lending Bee Inc. is a leading hard money lender with a strong reputation and over 20 years of experience in the real estate finance industry. Our popular loan products include commercial loans, fix and flip, constructional loans, residential and bridge loans. Our commitment to personalized lending sets us apart, as we understand that each borrower’s circumstances are unique. With our expertise and support, you can concentrate on expanding your portfolio while we take care of securing the financing you need.

Learn MoreWhether you're a seasoned investor looking to diversify your portfolio or a newcomer eager to make your first foray into real estate, our experts are here to guide you through every step of the process.

We Manage Own Funds That Help Us Act Fast And Get Flexible

Being a part of financial group, Lending Bee accumulates funds through LBC Capital Debt Income Fund. Members of the Fund who are purely accredited investors, invest in real estate loans and allow us being on top of any real estate investment game.

Our members benefit from 8% returns and low-risk investment’s opportunities.

Learn More

Our authority in the hard money lending space is built on a foundation of successful outcomes and satisfied clients. Over the years, we’ve not only adapted to the ever-changing real estate landscape but have also been at the forefront of innovation in lending practices. Our advice and financial solutions are sought after by investors, brokers, and real estate professionals. And we are proud of the feedback they provide.

Why us

- Close in 3-7 days

- Our rates start from 9.99%

- We arrange LTVs up to 80%

- We accept credit scores 450+

- We require minimal docs

- 20+ years of experience

- We work with almost all property types

Trust is the cornerstone of our relationship with clients. At Lending Bee Inc., we prioritize transparency, integrity, and personalized service. We understand the importance of trust, especially in financial dealings, and go above and beyond to ensure our clients feel confident and secure in their partnerships with us. Our commitment to ethical practices and client success has earned us not just business, but loyalty and referrals, growing our community of investors and professionals who choose Lending Bee Inc. time and again.

Direct Private Money Loans for California Real Estate

Lending Bee, Inc. is a very well-recognized name amongst the best hard money lenders in California, with decades of experience in private money lending. Our hard money loans are designed for real estate investors and property owners needing quick and flexible financing for various projects, including single-family homes, multi-family residences, and commercial properties.

With Lending Bee, Inc., California investors and homeowners can expect swift approvals, competitive rates, and personalized service. Our asset-based lending approach ensures that hard money loans for investment properties can be funded in as little as five days. Whether you’re an individual, LLC, corporation, trust, or estate, Lending Bee, Inc. is here to provide expert guidance and tailored financial solutions. Contact us now for a free consultation!

Your California Hard Money Loan Experts

To date, no other company has risen to the level of professionalism and expertise that Lending Bee, Inc. has brought into the hard money lending industry. Having funded over $800 million in hard money loans, with decades of experience, has earned us the trust of thousands of valued clients throughout California. Transparency with us means no hidden fees, just clear and upfront pricing on every loan.

Our clients appreciate our speed and reliability. Most loans are funded within five days, with same-day approvals for qualified borrowers. By offering customized solutions to meet the diverse needs of Lending Bee, Inc., it remains a trusted partner for real estate investors and property owners across the state.

Experienced California Hard Money Lenders

Lending Bee, Inc. is one of California’s preeminent direct hard money lenders specializing in financing an array of loan types including bridge loans, probate loans, trust loans, fix-and-flip financing, and commercial property loans. Our asset-based lending approach focuses on the real estate asset value and/or borrower equity, thus allowing our financing options to be granted with more speed and efficiency by offering programs tailored to each specific need.

Fast and Flexible Hard Money Loans Across California

Located in California, Lending Bee, Inc. offers California hard money loans efficiently, promptly, and across all regions: Southern, Central, and Northern California. We work from San Diego to San Francisco, providing direct private money loans as per the requirements of real estate investors. Emphasis is given to single-family homes, multifamily properties, and commercial real estate projects.

With a proven track record of satisfied clients, Lending Bee, Inc. has become a trusted name in hard money lending. Real estate investors return to us over and over again, confident in our ability to deliver professional, honest, and efficient financing solutions.

Diverse Hard Money Loan Options for Real Estate Investors

Lending Bee, Inc., has a wide array of hard money loan options to cater to the special needs of investors and owners in real estate. Be it bridge loans, cash-out refinance, trust loans, or fix-and-flip project financing, we know how to get you just the right solution. We can also arrange loans for probate or estate transactions, distressed property purchase, or residential and commercial construction.

Lending Bee, Inc. pays attention to the value of the property and the equity of the borrower, thus ensuring a smooth approval process often able to provide funding in as little as five days. Our speed, flexibility, and great service have made us steadfastly dedicated to California’s unparalleled real estate market.

Serving All Corners of California

Lending Bee, Inc. proudly serves hard money loans throughout California, including San Diego, Los Angeles, Orange County, the San Francisco Bay Area, Sacramento, and more. From bustling urban centers to quieter suburban regions, we offer tailored lending solutions for real estate investors and property owners. Our expertise spans single-family homes, multi-family properties, and commercial real estate, ensuring we meet the diverse needs of our clients.

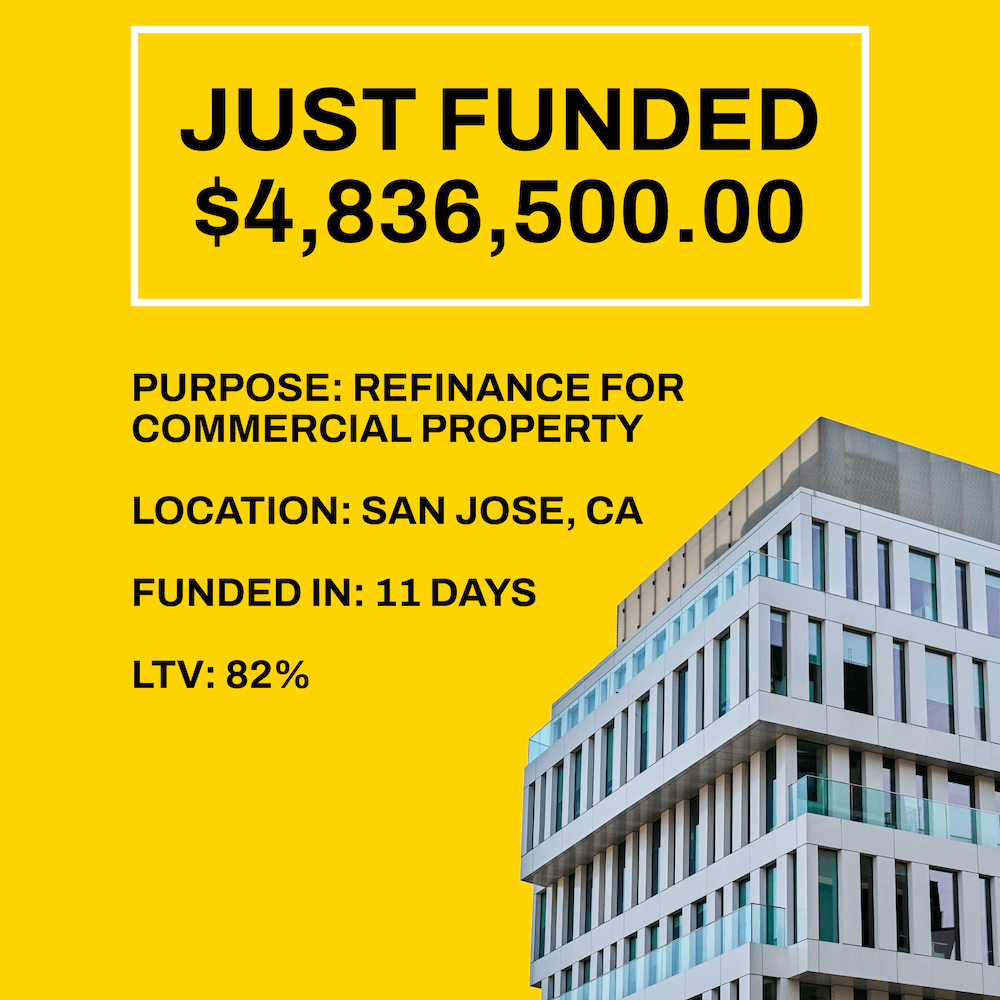

Latest funded deals

More projectsBlog

More articlesFast and flexible financing for your real estate investment projects in California

Lending Bee Inc offers a variety of hard money loan options secured by real estate, including fix and flip loans, bridge loans, and construction loans. Our team of experts will work closely with you to find the right loan option and guide you through the entire loan process. Contact us today to learn more.

Stay Up To Date With Lending Bee

Subscribe to the newsletter of useful information from Lending Bee